Form 1099-MISC Instructions & Tax Reporting Pointers

Prior to 2020, the 1099-MISC was used to report a variety of payments including payments to independent contractors. Beginning with 2020, payments made to independent contractors are reported via 1099-NEC.

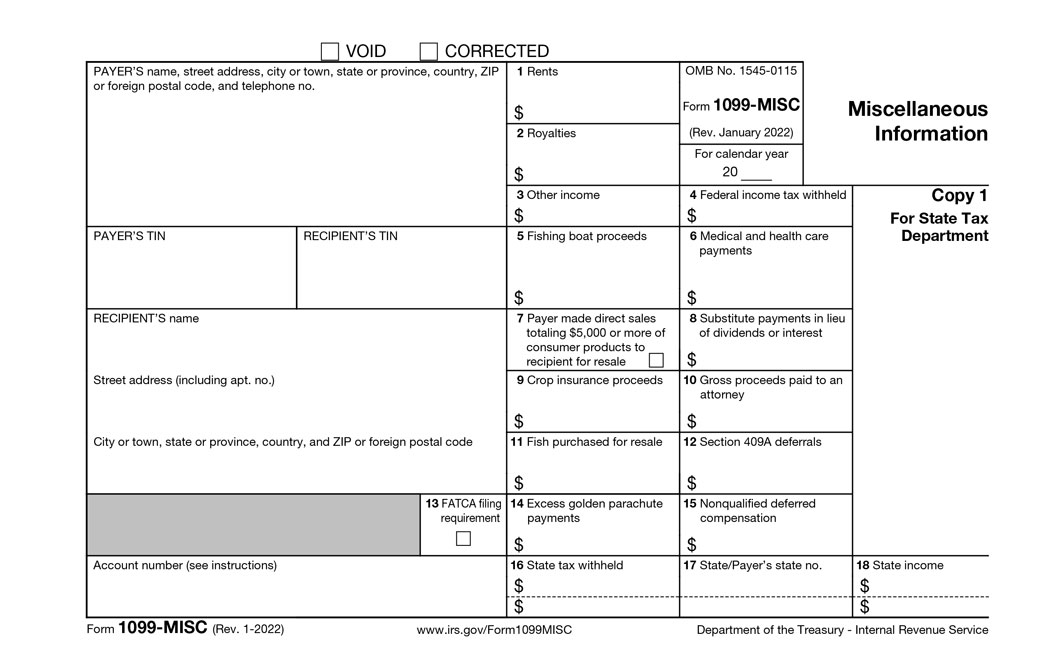

Payments covered by the 1099-MISC include:

To complete a 1099-MISC, you'll need to supply the following data:

Business information – Your Federal Employer ID Number (EIN), your business name and your business address.

Recipient's ID Number – The recipient's Taxpayer Identification Number (TIN) or Federal Employer ID Number (EIN).

Payment Amounts – Enter amounts paid in the appropriate box:

Section 409A Deferrals and Income - Box 12 requires you to record Section 409A deferrals and income, which pertains to non-qualified deferral compensation plans.

State and Local Information - Enter the amount of state tax withheld (Box 16), the state/payer's state number (Box 17) and state income (Box 18).

There may be instances in which you need to provide both a 1099-MISC and 1099-NEC to the same individual, however that will depend on the business conducted with them in that year. If you are unsure it’s always best to consult a tax attorney in order to remain compliant.

The 1099-MISC is a multi-part form that is handled as follows:

Copy A — File with IRS by the paper or electronic-filing deadline.

Copy 1/State Copy — File with the appropriate state taxing authority, if applicable.

Copy B — Distribute this copy to individuals, who then file it with their federal income tax return. You will meet the IRS’ distribution requirement if the form is properly addressed and mailed on or before this due date.

Copy 2 — Distribute this copy to individuals. If applicable, individuals will then file this copy with their state taxing authority.

Free to try.

You only pay when you're ready to file.