Easily File and Deliver 1099, W-2 and ACA Forms Online

Get all-inclusive print, mail and e-file services quickly, efficiently and securely from an IRS-approved provider — for as low as $1.50 per form. View Pricing

Faster than filing paper forms

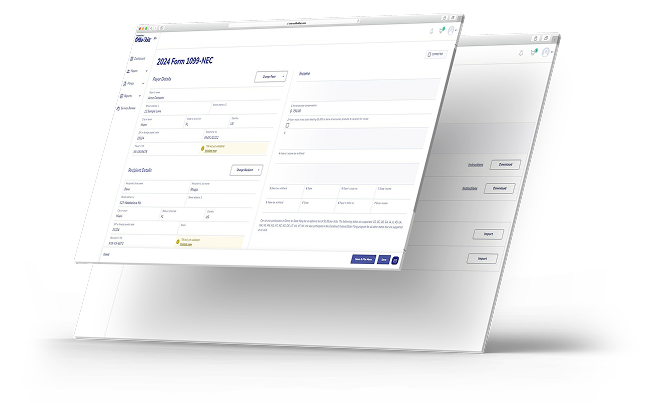

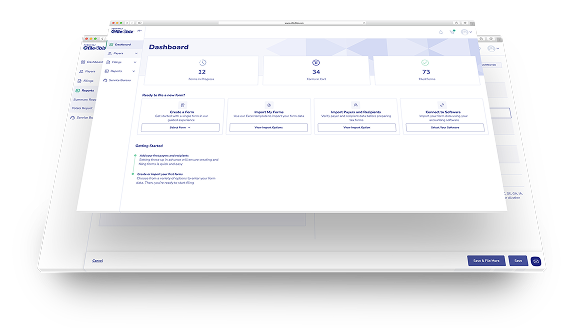

Whether you're filing one form or thousands, filing your 1099s, W-2s and ACA forms online eliminates steps, saving you precious time. Simply fill out your form(s) directly and securely on our website and submit your order. We take care of printing and mailing the forms to your recipients, as well as e-filing your forms directly with the IRS or SSA.

- Skip filling out Form 1096 or W-3 because we automatically calculate the totals and transmit that information electronically.

- Have lots of forms to file? Upload them all at once with our Excel templates, or import directly from QuickBooks and Xero to save even more time.

Easier than software

Our simple, end-to-end, cloud-based service eliminates the need for cumbersome business tax filing software you have to download or methods that require printing on forms and envelopes.

- No need to download or install software. Access your records and forms on efile4Biz.com from any device with internet access.

- Updates and new features are free and automatic. You'll never have to purchase a software upgrade – just pay for the forms you file or the services you need.

- Maintain access to filed forms for at least four years. No need to save and print copies of your records for offline storage.

Who Uses efile4Biz

Businesses use efile4Biz to save on the labor costs of printing, mailing and manually submitting forms to the IRS.

Accountants and Tax Preparers use efile4Biz to maintain and file forms for multiple clients under one account every year. We offer two different subscription plans for customers that have larger teams and need different levels of service and different permission levels for various roles. View details about the Plus Subscription and the Premium Subscription and see how these plans can help your team.

Large Volume Businesses (including payroll, PEO, accounting and property management companies) with more than 300 forms can also use our Service Bureau as a labor-saving secure alternative to processing forms internally.

Everyone can use efile4Biz to save precious time by filing online through our secure website.

Trusted by more than 100,000

Here's what some of our customers are saying...

Connect with your favorite software

Efile4Biz integrates with these popular packages so you can quickly import your vendor data, complete 1099 forms and electronically file your data to the IRS.

Transfer 1099 data from your Xero account!

Transferring contacts from your Xero Online Accounting Software takes just a few clicks, making it easy to complete your 1099 forms.

Import QuickBooks Online 1099 Vendors with just one click!

Seamlessly import 1099 vendors right from your QuickBooks Desktop, QuickBooks Online Plus or QuickBooks Online Accountant.