Get Clear on the Difference Between the 1099-MISC and 1099-NEC

The IRS introduced the 1099-NEC in 2020, which changes how business owners and tax professionals handle certain types of tax reporting. Basically, the Form 1099-NEC replaced Form 1099-MISC for reporting nonemployee compensation (in Box 7), shifting the role of the 1099-MISC for reporting all other types of compensation.

Here's some more guidance on the difference between the 1099-MISC and 1099-NEC, and what you need to know to use the forms properly.

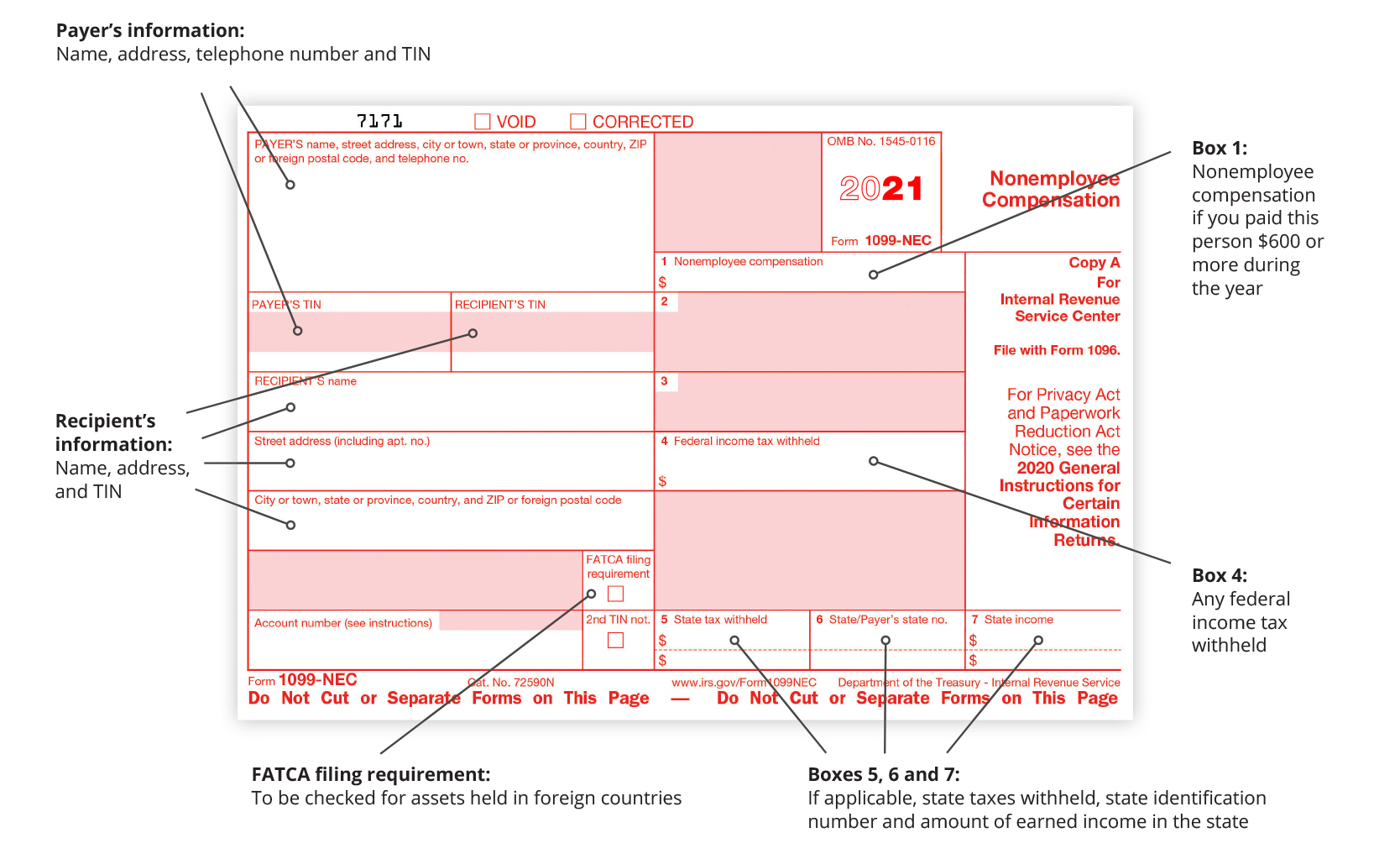

The 1099-NEC (NEC stands for Non-Employee Compensation) is actually based on an old form that has been out of use since 1982. The IRS revived the form to address some time-management and administrative issues that arose under the Protecting Americans from the Tax Hikes Act of 2015 (the PATH Act). The Form 1099-NEC effectively separates certain data from Box 7 of the 1099-MISC, in addition to staggering the filing due dates.

To work with the "reinstated" 1099-NEC properly, you need to be clear on what is considered nonemployee compensation. Basically, these are any payments to nonemployee service providers, such as independent contractors, freelancers, vendors, consultants and other self-employed individuals (commonly referred to as 1099 workers). Again, this is the information that previously appeared in Box 7 of the 1099-MISC.

According to the IRS, a combination of these four conditions distinguishes a reportable payment in Box 1 of the 1099-NEC:

Be aware: You must also file Form 1099-NEC (report in box 4) for anyone from whom you withheld federal income tax under the backup withholding rules, regardless of the amount.

For as smooth a process as possible with the new 1099-NEC, follow these important do's and don'ts:

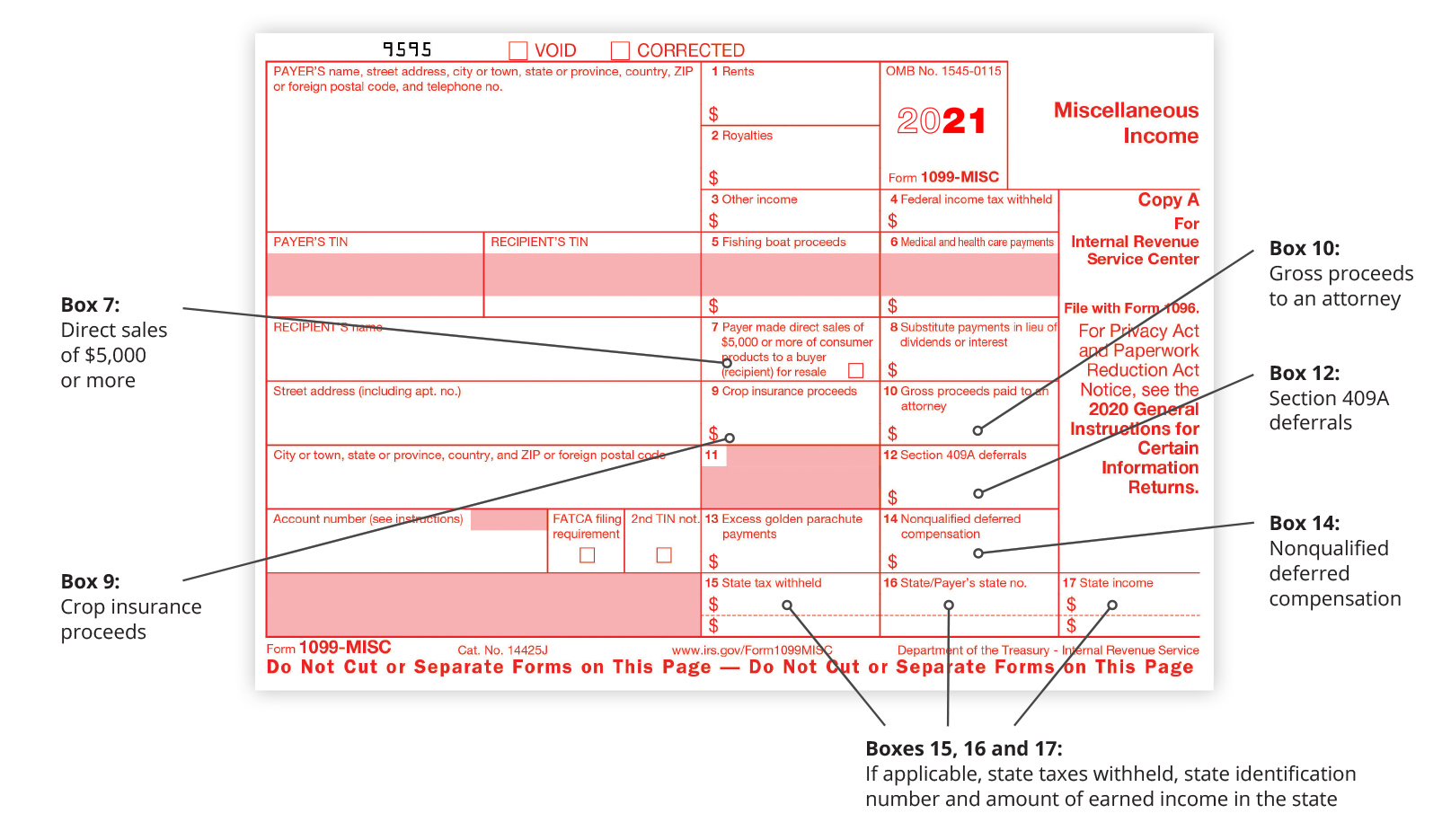

Because nonemployee compensation reporting has been removed from Form 1099-MISC for the 2021 tax season and beyond, the IRS has redesigned Form 1099-MISC.

The biggest change is Box 7, which is now checked off if the payer made direct sales of $5,000 or more. Additional reporting is completed in these areas:

For Form 1099-MISC, the deadlines depend on if data is in Box 8 or 10. The deadline for recipient distribution is Jan. 31 if no data is in Box 8 or 10, but Feb. 15 if there is data in Box 8 or 10. Regardless of Box 8 or 10, the 1099-MISC IRS filing deadlines are Feb. 28 if paper filing and Mar. 31 if filing electronically.

To learn more about the 1099-NEC and how it may impact your business, go here. When you work with a trusted e-file provider like efile4Biz.com, you never have to worry about monitoring tax form changes or other compliance issues. Our all-inclusive online service utilizes the latest IRS forms for all your 1099 and W-2 reporting needs.

Free to try.

You only pay when you're ready to file.