ACA Reporting Simplified - How to Meet IRS Requirements

Despite various attempts at “repeal and replace” the Affordable Care Act (ACA) remains intact. Not only that, but the IRS has stepped up its enforcement efforts. This means affected employers – those with 50 or more full-time employees including full time equivalent employees (FTEs) on business days during the preceding calendar year - must satisfy the annual ACA filing requirements for reporting on Form 1094 and Form 1095 or risk IRS filing penalties.

The Tax Cuts and Jobs Act passed in late 2017 created much of the confusion surrounding the status of the ACA. The new tax law modified the individual mandate requiring individuals to have ACA-compliant health coverage (by removing the penalty for non-compliance). Regardless, the employer mandate still stands.

The IRS has enhanced its system for identifying non-compliant ALEs (Applicable Large Employers) and continues to penalize employers who don’t report. First, the IRS sends out Letter 5699 informing the employer a reason for the contact and gives them general information about the filing requirements. It asks the employer to respond to the letter by marking the appropriate block and returning it as directed in the letter. Failure to respond with the necessary information could result in the IRS determining that the employer is liable for an Employer Shared Responsibility Payment (ESRP). From there, the IRS sends out Letter 226J to notify employers of any penalty assessments. To date, over 30,000 letters have been sent levying over $4 billion in fines.

For tax year 2025 (filed in calendar year 2026), in addition to the various information return filing and furnishing penalties, there are still 2 more types of penalties that could be assessed to employers for failing to comply with the specific requirements to provide essential and affordable healthcare coverage to eligible employees and their dependents.

The first type of penalty, the “A” Penalty – IRC 4980H(a), Employer Shared Responsibility Payment for Failure to Offer Minimum Essential Coverage to at least 95% of a company’s full-time employees (and their dependents).

A second type of penalty, the “B” Penalty – IRC 4980H(b), Employer Shared Responsibility Payment for Failure to Offer Coverage that Meets Affordability and Minimum Value.

As in years past, if you are determined to be an ALE, it’s essential to offer appropriate healthcare coverage – and to report it through the proper 1094/1095 forms – to avoid these costly penalties.

The ACA reporting requirements are enforced by two sections of the Internal Revenue Code. Together, they ensure that employers (and health insurance providers) report health coverage information to the IRS and furnish statements to employees upon request.

Section 6055 reporting requirements apply to health insurance carriers, small employers that sponsor self-funded health plans and other entities that provide minimum essential coverage.

Section 6056 reporting requirements are directed toward applicable large employers (ALEs) with 50 or more full-time employees or full-time equivalent employees (FTEs). Section 6056 also requires ALEs, upon request, to share coverage details with employees to calculate eligibility for any premium tax credit.

Through mandatory information reporting, tax code sections 6055 and 6056 help ensure compliance with the ACA – particularly the Employer Shared Responsibility provision, which applies to ALEs. Basically, if you're an ALE and don't offer health insurance to your full-time employees that provides a minimum level of coverage and is legally affordable, you may be subject to financial penalties.

For purposes of reporting, minimum essential coverage, or MEC, refers to a legally definable level of coverage.

You may be penalized if you don't offer minimum essential health coverage to at least 95 percent of your full-time employees and their dependents, and at least one full-time employee receives a premium tax credit through the health insurance marketplace.

A second type of penalty may be triggered if you offer minimum essential coverage, as described above, but the coverage wasn't considered affordable or didn't provide the minimum required value.

Most broad-based medical plans meet the legal parameters for minimum value, where the plan pays for at least 60 percent of covered benefits. Regarding affordability, the 2026 premium for the lowest cost, self-only minimum value coverage should be less than 9.96 percent of an employee's gross household income. You can use one of the three safe harbor tests to determine if the coverage you're providing is affordable, without needing to know every employee's household income. 1) Form W-2 Safe Harbor, 2) Rate of Pay Safe Harbor and 3) Federal Poverty Line Safe Harbor.

Minimum essential coverage includes:

Minimum essential coverage doesn’t include coverage consisting solely of excepted benefits. Excepted benefits include vision and dental coverage not part of a comprehensive health insurance plan, workers’ compensation coverage, and coverage limited to a specified disease or illness.

1095-B

Health Coverage

Self-insured employers who have fewer than 50 FTEs and provide health plans

Insurance carrier issues for employers with employer-sponsored group health plans

Which months the insured and his or her family were covered under the plan

Paper:

March 2, 2026

Electronic:

March 31, 2026

Insurance carrier submits for

employers with employer-sponsored group health plans

By request**

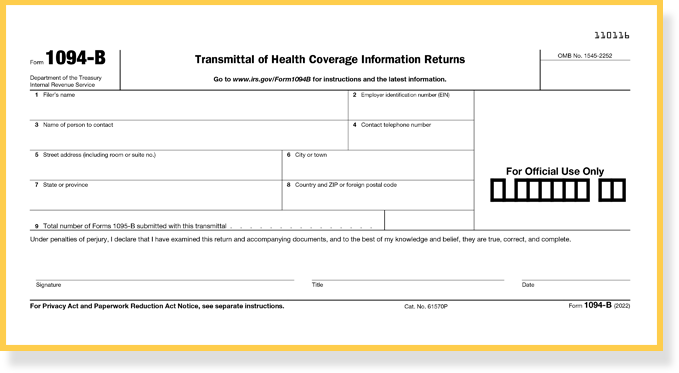

1094-B

Transmittal of

Health Coverage Information Returns

Transmittal

record of

1095-Bs

Paper:

March 2, 2026

Electronic:

March 31, 2026

N/A

1095-C

Employer-Provided Health Insurance Offer and Coverage

(ALEs) Insured and Self-Insured Employers with 50+ full-time employees

Whether or not the employer offered health coverage to employees

Paper:

March 2, 2026

Electronic:

March 31, 2026

By request**

1094-C

Transmittal of Employer-Provided Health Insurance

Offer and Coverage Information Returns

Authoritative Transmittal for each Applicable Large Employer and Summary of 1095-Cs

Paper:

March 2, 2026

Electronic:

March 31, 2026

N/A

** Issuers are no longer automatically required to furnish copies to recipients. However, if recipients request copies the issuer must comply. If requested prior to January 1, the issuer must furnish by January 31 (or next business day when January 31 falls on the weekend). If the request is made after January 1, the issuer must furnish by 30 days after requested.

ACA reporting responsibilities depend on employer size and the type of insurance you maintain, whether insured or self-insured.

In general, the reporting requirements apply if you're an employer with 50 or more full-time employees or equivalents, a self-insured employer, regardless of size, or a health insurance provider. The IRS forms used to report this information are 1095-B and 1095-C, along with transmittal forms 1094-B and 1094-C.

For clarification, you're a self-insured -- or self-funded – employer if you pay for medical claims directly instead of paying premiums to an insurance provider.

Do

you have

50 or more

full-time equivelent employees (FTEs)

Do you offer health coverage

Do you offer health coverage

Is your

health plan self-insured

Is your

health plan self-insured

Form 1095-B

(Parts I, III & IV) and Form 1094-B

A copy of

1095-B must be provided to employees upon request.

Form 1095-C

(Parts I & II) and Form 1094-C

A copy of

1095-C must be provided to employees upon request.

Form 1095-C

(Parts I, II & III) and Form 1094-C

A copy of

1095-C must be provided to employees upon request.

Form 1095-C

(Parts I, III & IV) and Form 1094-C

A copy of

1095-C must be provided to employees upon request.

There are relatively few small businesses that must comply with ACA reporting requirements.

The ACA defines a small business as those with fewer than 50 full-time employees, or FTEs.

Self-insured businesses, complete the 1095-B (and 1094-B transmittal form) to report the name, address, SSN or other TIN, Date of Birth (if SSN or other TIN is not available) and months of coverage for the employee and any covered individuals.

Small businesses that aren't self-insured don't need to report offers of health coverage to the IRS and are not required to furnish any statements to employees.

The ACA reporting requirements primarily affect applicable large employers—those with 50 or more full-time or full-time equivalent employees.

Keep in mind an ALE may be a single entity or may consist of a group of related entities under common control or an Aggregated ALE Group. Examples include parent and subsidiary, or other affiliated entities. If the Aggregated ALE Group, considering the employees of all ALE Members in the group, employed on average 50 or more full-time employees (including full-time equivalent employees) on business days during the preceding calendar year, then the Aggregated ALE Group is an Applicable Large Employer and each separate employer within the group is an ALE Member. Each ALE Member is required to report offers of coverage to its full-time employees (even if the ALE Member has fewer than 50 full-time employees of its own). Each ALE Member must file its own forms under its own separate EIN, even if the ALE Member is part of an Aggregated ALE Group. No Authoritative Transmittal should be filed for an Aggregated ALE Group.

Since the definition of an applicable large employer includes full-time and full-time equivalent employees in a preceding calendar year, it's important to understand the distinctions.

Note: Hours of services represent each hour an employee is paid or entitled to payment, including vacation, leave, holiday, illness, incapacity, layoff, jury duty, military duty and other leaves of absence.

To determine the number of full-time equivalent employees for a month:

Once you've calculated your FTEs, add that number to your total number of full-time employees on staff to determine whether or not you're an applicable large employer.

Keeping track of the number of full-time and full-time equivalent employees, as it pertains to the ALE classification, is critical. This classification is determined each calendar year and depends on the average size of your workforce in the prior year.

Not included in the calculation are owners of a sole proprietorship, partners, shareholders owning more than 2% of an S corporation, owners of more than 5% of other businesses, family members or members of the household who qualify as dependents on the individual income tax return of a person listed above, including a spouse, child (or descendant of a child), sibling or step-sibling, and parent (or ancestor of a parent), step parent, niece or nephew, aunt or uncle, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law, seasonal workers working 120 days or less in a year, independent contractors (Form 1099 workers), COBRA and retired enrollees.

Calculating Full-Time equivalent (FTE) Employee hours for ACA reporting can be confusing and complicated. Errors in the calculations can lead to penalties and fines. You may want to consider investing in time-tracking software designed for ACA compliance, or choose to outsource this responsibility to a payroll vendor with specific skills to determine the appropriate treatment of employees with varying schedules.

Self-insured businesses with fewer than 50 full-time employees must complete Form 1095-B (and the 1094-B transmittal form if not e-filing).

To report the necessary information to the IRS and furnish a form to employees, you'll need to complete:

The 1094-B transmittal form represents the total 1095-B filings submitted. Acting as a cover sheet for paper filed forms, it is a brief form that includes:

To satisfy the reporting requirements, fully insured and self-insured applicable large employers must complete Form 1095-C (and the 1094-C transmittal form).

If you offer health insurance, you'll complete Parts I and II of the 1095-C. Self-insured employers will complete Parts I, II and III. Every employee of an ALE who is eligible for insurance can request to receive a 1095-C. That means even eligible employees who decline to participate in an employer's health plan can request to receive a 1095-C.

To report the necessary information to the IRS and furnish a form to employees, you'll need to capture a number of details, as follows:

All ALEs need to submit this form (Parts I, II, and III) even if they do not offer insurance and are not self-insured. In addition, upon request, employers must furnish a copy of the 1095-C to the employee.

Most of the effort involved in completing Form 1095-C centers on Lines 14 through 17 in Part 2.

The "Offer of Coverage" on Line 14 – which involves eleven codes, 1A through 1U -- describes whether or not minimum essential coverage was offered to an employee, spouse and/or any dependents. This information is focused on the offer of coverage—not necessarily whether coverage was actually provided. If one code applies for the entire 12 months, you only need to enter it once in the "All 12 Months" column.

For example, if an employee was offered coverage that included both themselves and their spouse, but chose to enroll in employee-only coverage then Line 14 must indicate that the employee was offered family coverage.

On Line 15, report the amount of the Employee Required Contribution generally, the employee share of the monthly cost for the lowest-cost, self-only, minimum essential coverage providing minimum value that is offered to the employee. This helps the IRS determine if affordable coverage was made available to the employee. Only complete this section if code IB, IC, ID, IE, IJ, IK, IL, IM, IN, IO, IP, IQ, IT or IU is entered on line 14 either in the "All 12 Months" box or in any of the monthly boxes. Include cents with this figure and don't round numbers. If you entered 1A on Line 14, nothing needs to be entered on Line 15 because this code indicates you offered essential coverage providing minimum value to the employee, spouse and/or dependents.

Note that the amount entered might not be the amount the employee is paying for the coverage, for example, if the employee chose to enroll in more expensive coverage, such as family coverage, or if the employee is eligible for certain other healthcare arrangements.

Line 16 – has nine codes available. Codes 2A-2I are used to report for 1 or more months of the calendar year that one of the following situations applied to the employee. The employee was not employed or was not a full-time employee, the employee enrolled in the minimum essential coverage offered, the employee was in a Limited Non-Assessment Period with respect to section 4980H(b), the ALE Member met one of the Section 4980H affordability safe harbors with respect to this employee, or the ALE Member was eligible for multiemployer interim rule relief for this employee. If no indicator code applies, leave line 16 blank. In some circumstances, more than one indicator code could apply to the same employee in the same month. For example, an employee could be enrolled in health coverage for a particular month during which they are not a full-time employee. However, only one code may be used for a particular calendar month. Note: There is no code to enter on line 16 to indicate that a full-time employee offered coverage either did not enroll in the coverage or waived the coverage.

If the ALE Member used code 1L, 1M, 1N, 1O, 1P, 1Q, 1T, or 1U because it offered the employee an individual coverage Health Reimbursement Arrangement (HRA), an employer-funded health benefit plan that reimburses employees for qualified medical expenses and, in some cases, health insurance premiums, enter the appropriate ZIP code used for identifying the lowest cost silver plan used to calculate the Employee Required Contribution in line 15. This will be the ZIP code of the employee’s residence (code 1L, 1M, 1N, or 1T) or the ZIP code of the employee’s primary site of employment if the ALE Member uses the work location safe harbor (code 1O, 1P, 1Q, or 1U).

Work location safe harbor for individual coverage HRAs. For purposes of section 4980H(b), an employer may use the cost of self-only coverage for the lowest cost silver plan for the employee for self-only coverage offered through the Exchange where the employee’s primary site of employment is located for determining whether an offer of an individual coverage HRA to a full-time employee is affordable. The ZIP code for the employee’s primary site of employment is used to identify the applicable lowest cost silver plan to determine affordability.

An ALE Member must file a Form 1094-C designated as the Authoritative Transmittal, used to report to the IRS summary information for each Applicable Large Employer and to transmit paper filed Forms 1095-C to the IRS.

Part I Applicable Large Employer Member (ALE Member) information includes:

Part II ALE Member Information includes:

The deadlines for filing Forms 1094 and 1095—whether by paper or electronically—differ from those for other information returns and W-2s. This means:

March 2, 2026

Paper filing of 1095s

(and 1094 transmittals) to IRS

February 2, 2026

Or Within 30 Days of Request*

Form 1095 copies to recipients/employees

March 31, 2026

E-filing of 1095s

(and 1094 transmittals) to IRS

* Issuers are no longer automatically required to furnish copies to recipients. However, if recipients request copies the issuer must comply. If requested prior to January 1, the issuer must furnish by January 31 (or next business day when January 31 falls on the weekend). If the request is made after January 1, the issuer must furnish by 30 days after requested.

https://www.congress.gov/bill/118th-congress/house-bill/3797

Electronic filing is required if the employer files 10 or more forms or returns during the calendar year. The 10 or more total includes partnership returns, corporate income tax returns, unrelated business income tax returns, withholding tax returns, certain information returns, registration statements, disclosure statements, notifications, actuarial reports, and certain excise tax returns. Filers are required to aggregate almost all information return types to determine if the total exceeds the 10 return limit.

In addition to any Employer Shared Responsibility Penalties, employers must also adhere to any requirements to file to IRS and furnish to recipients (upon request) forms that comply with the Sections 6721 and 6722 information return standards. If an employer fails to file a correct information return by the due date and cannot show reasonable cause, the employer may be subject to a penalty. The Section 6721 penalty applies for:

The Section 6722 penalty is a separate penalty and is applied in the same manner as the penalty for section 6721 violations. Basically, if the employee requests a copy of the form, you fail to provide it and you cannot show reasonable cause, you may be subject to a penalty.

The penalty applies for:

| Reporting Penalty | Amount of Penalty |

|---|---|

| Failure to file with the IRS Section 6721 | $340/form $4,098,500 calendar year maxiumum |

| Failure to furnish a requested recipient copy Section 6722 | $340/form $4,098,500 calendar year maxiumum |

| Filed/furnished after August 1 or not at all Combined calendar year maximum |

$340/form $8,197,000 ($2,732,000 for small businesses) |

| Intentional Disregard to file/furnish | $680/form no calendar year maxiumum |

The information gathering process can be challenging for many businesses. Data collection and completing the forms accurately and on time will require careful coordination, information sharing, and ongoing monitoring. To capture all the information required to complete Form 1094 and Form 1095 reporting, employers will need to compile health coverage data from several key internal sources including:

And external sources of information, such as:

Because the employee's personal information and health insurer appear on the same form, the data is considered protected health information (PHI). Strict security is necessary to protect the information from unauthorized use. It is essential that employers use a filing provider that is SOC-certified and HIPAA-compliant, to ensure an added layer of protection is in place to maintain the strictest standards of data security. Efile4biz offers several levels of secure form and data handling to protect your employee’s personal information including printing forms at a SOC-2 certified facility and mailing to recipients via first-class mail or electronic delivery utilizing multi-factor authentication to prevent unauthorized access to the forms.

A few essential Dos and Don'ts will ensure a smooth filing process:

| Features | Paper

Forms |

Desktop

Software |

efile4Biz |

|---|---|---|---|

| Per-form pricing | clear | clear | done |

| Import Payer, recipient and form data | clear | done | done |

| Summary and Totals reporting to validate filings | clear | done | done |

| Live Chat support | clear | clear | done |

| Email support | clear | done | done |

| Includes delivery of recipient copies | clear | clear | done |

| ACA reporting | done | done | done |

| 1099 reporting | done | done | done |

| W-2 reporting | done | done | done |

| Integrated with online accounting software | clear | clear | done |

It is important to keep HIPAA compliance in mind when filing healthcare coverage ACA forms, 1095-B and 1095-C. These forms may contain protected health information (PHI), meaning an employer's medical plan is a covered entity subject to HIPAA privacy, security and breach notification rules.

When gathering information for Forms 1095-B and 1095-C, it is probable that you will require Social Security numbers (SSNs) for employees, as well as spouses and dependents covered under the plan.

Collecting SSNs for employees may be a common occurrence, but now you face the added responsibility of obtaining SSNs for spouses and dependents with the ACA reporting requirement, thereby increasing the risk of data privacy and security breaches.

To take the necessary precautions when handling sensitive data, here are some useful tips:

Determine whether the information gathered for ACA reporting is protected health information (PHI) under HIPAA, or if it falls under any HIPAA exception.

If data gathered is PHI, certain measures need to be taken under the HIPAA privacy and security rules. All employees should be trained on PHI policies and procedures, with a designated privacy officer implementing practices, including appropriate administrative, technical and physical safeguards to protect the privacy of PHI. All unauthorized use or disclosure of PHI should be reported.

Third-party vendors are approved by the IRS and can assist in the ACA reporting process. It is important to ensure that the vendor, even as a "business associate" under HIPAA, is HIPAA-certified and contractually bound to maintain and implement the appropriate privacy and security practices.

Need assistance to comply with the many demands of ACA healthcare information reporting requirements? Choose efile4Biz.com for quick, efficient and secure e-filing for ACA forms in addition to various other information returns and wage reporting statements including 1098s, 1099s, W2s and Form 1042-S. Our online portal is secure, convenient and with the easy-to-use interface you can complete the forms quickly, saving valuable time. There's no software to download and no paper forms to purchase, you enjoy streamlined, one-step secure processing.

Take advantage of:

E-file support - Simply enter or import applicable employee information and efile4Biz.com will electronically file forms 1095-B, 1095-C, and Authoritative transmittal 1094-C with the IRS. Need to provide employee copies, the choice is yours. We offer First Class Mail or electronic delivery of employee copies.

Print and mail - For health insurance providers, payroll service providers and employers seeking high-volume processing of ACA forms, efile4Biz.com offers comprehensive print-and-mail services out of a secure, SOC and HIPAA-certified facility. SOC compliant means our print facility adheres to the System and Organization Controls (SOC) framework, demonstrating that we have effective internal controls in place for data security, privacy, and operational integrity. Efile4biz print facility also complies with the Health Insurance Portability and Accountability Act (HIPAA). This certification demonstrates that we have implemented the necessary safeguards to process Protected Health Information (PHI).

Free to try.

You only pay when you're ready to file.