How efile4Biz Works

Filing tax information returns is fast and easy with efile4Biz

Complete your forms in just minutes with these five easy steps. (Or, for large files, check out our upload options.)

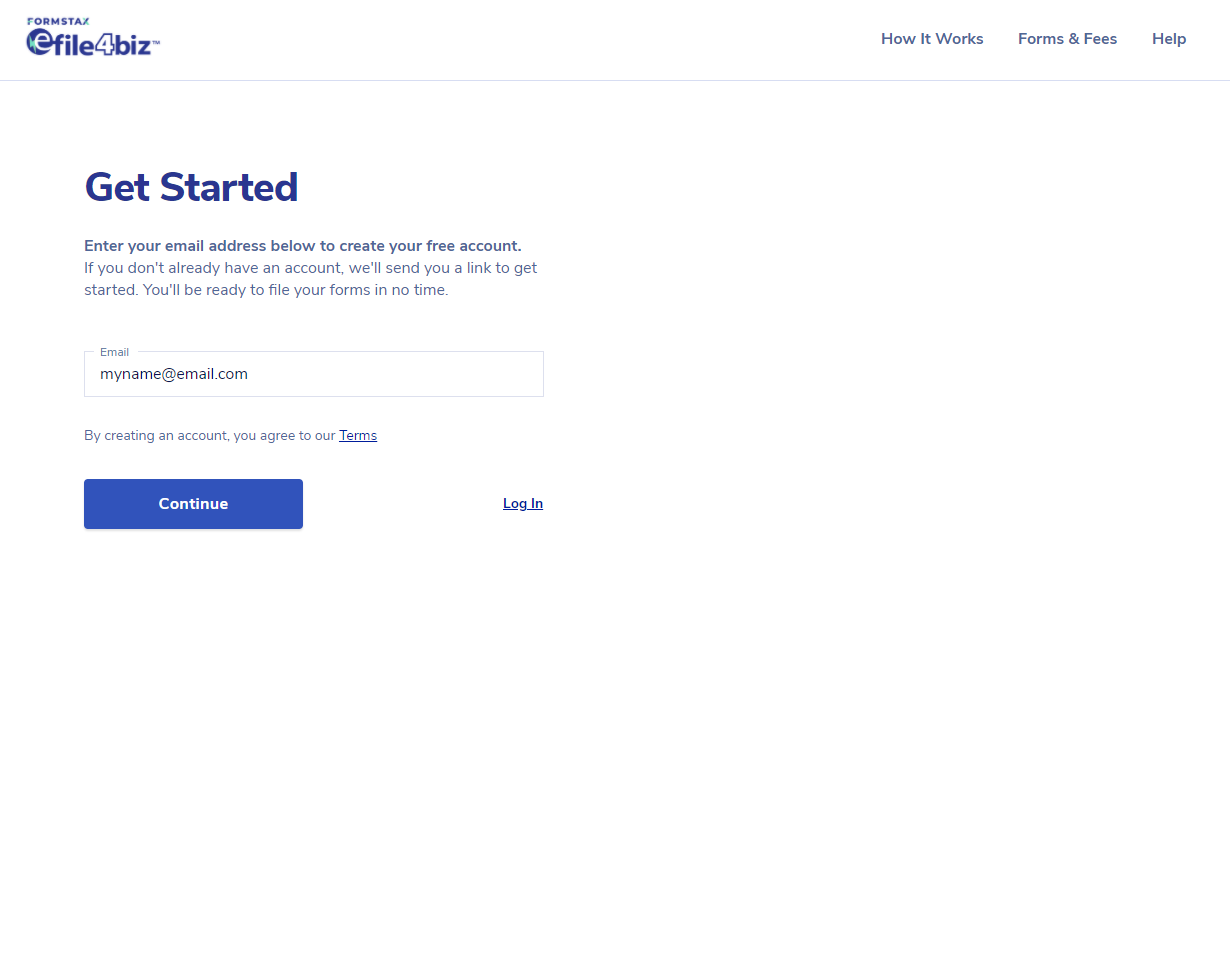

You can try out our service – including creating and saving forms – with no obligation. You don’t pay a cent, or even enter a credit card number, until you are ready to file a form and check out.

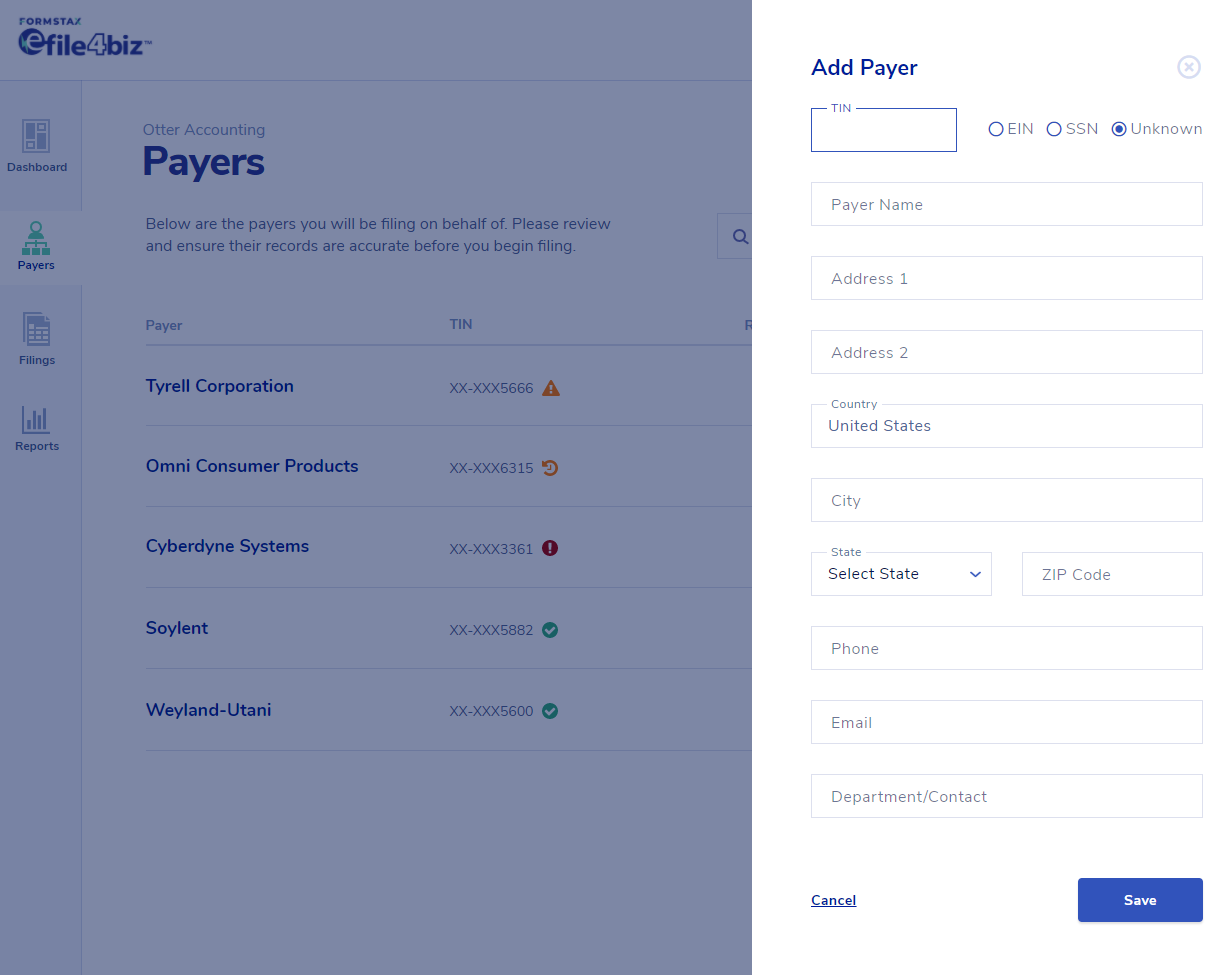

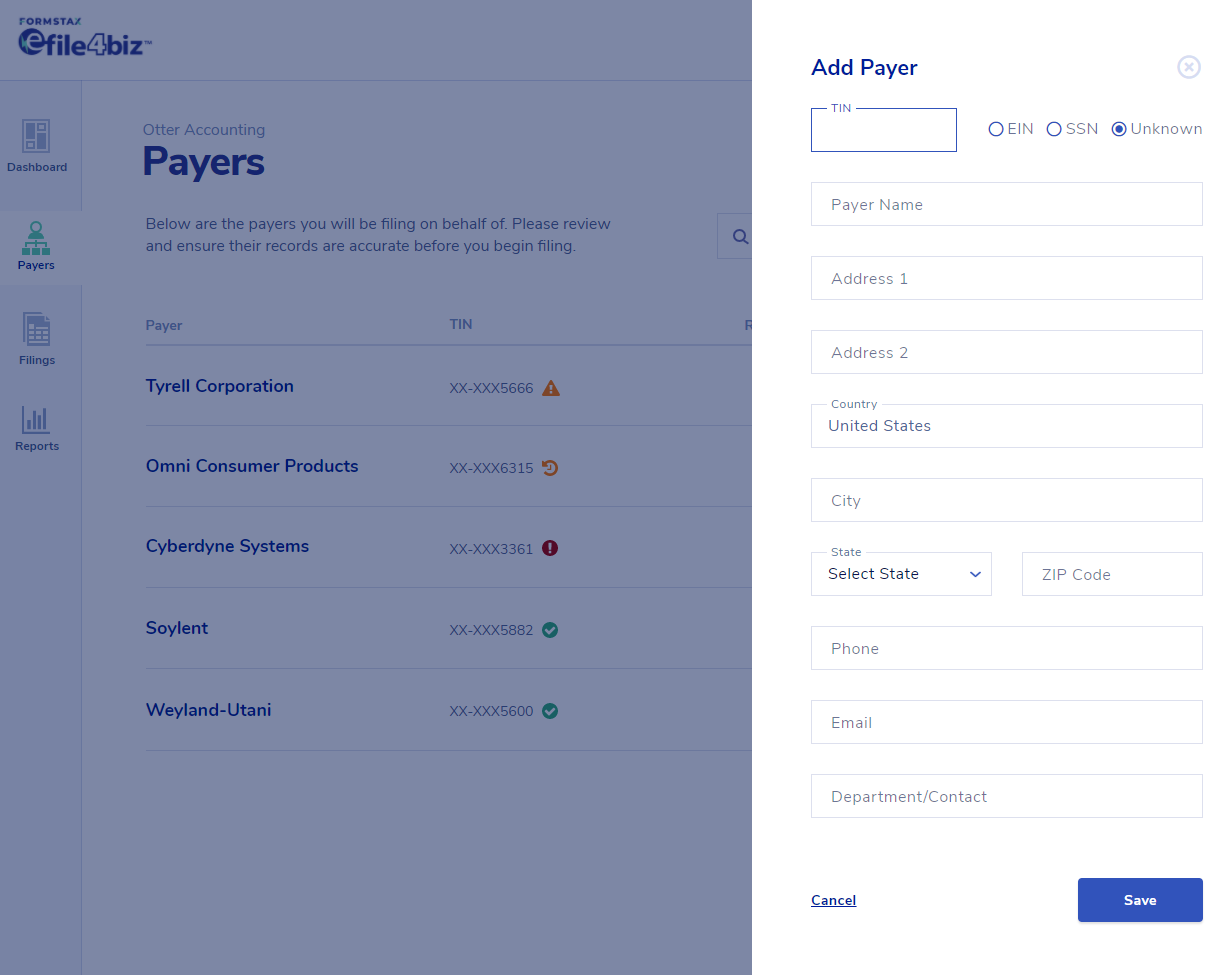

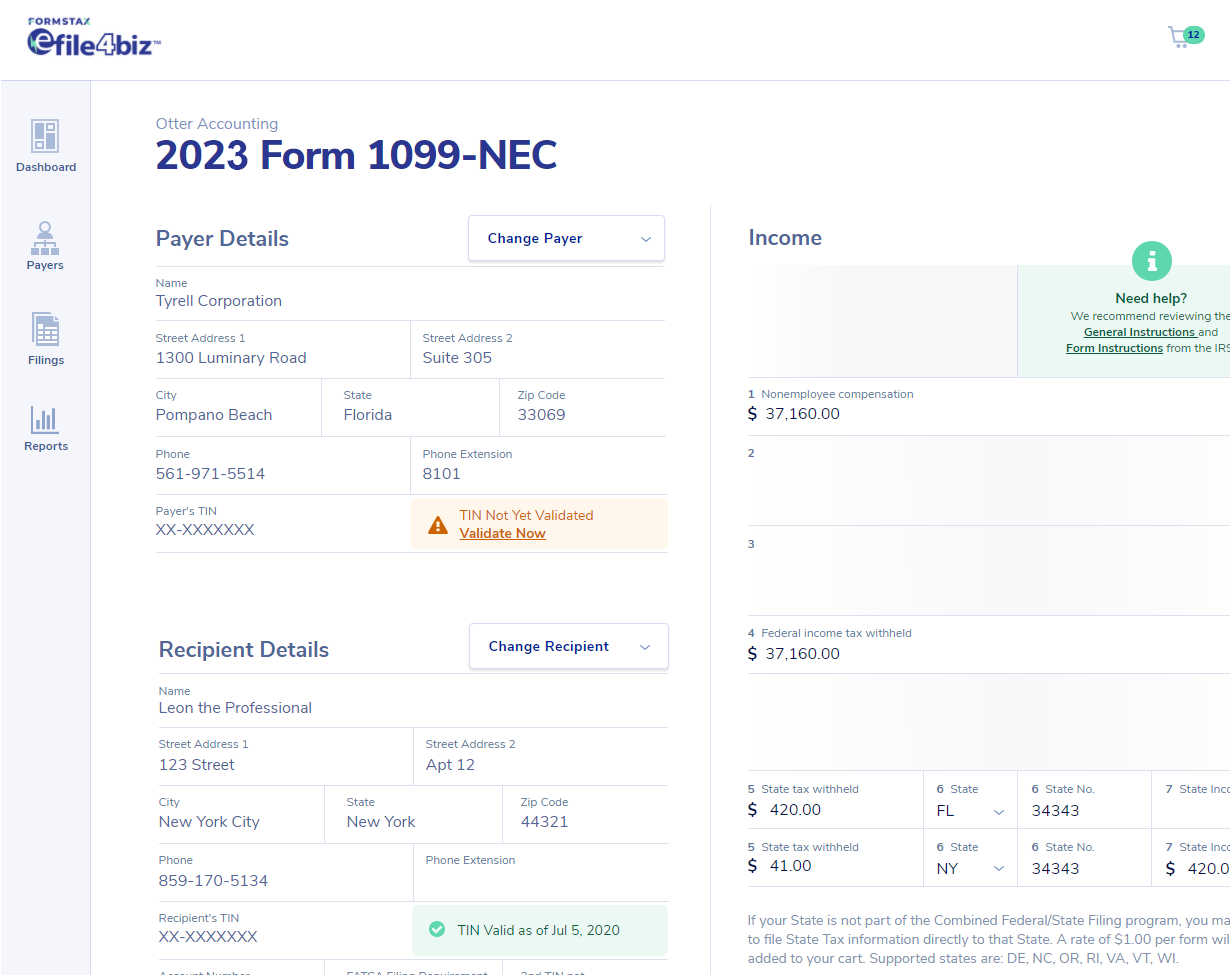

The "payer" is the company or other entity that paid the form recipient. If you’re preparing forms for more than one company or client, you can create additional payers under one account.

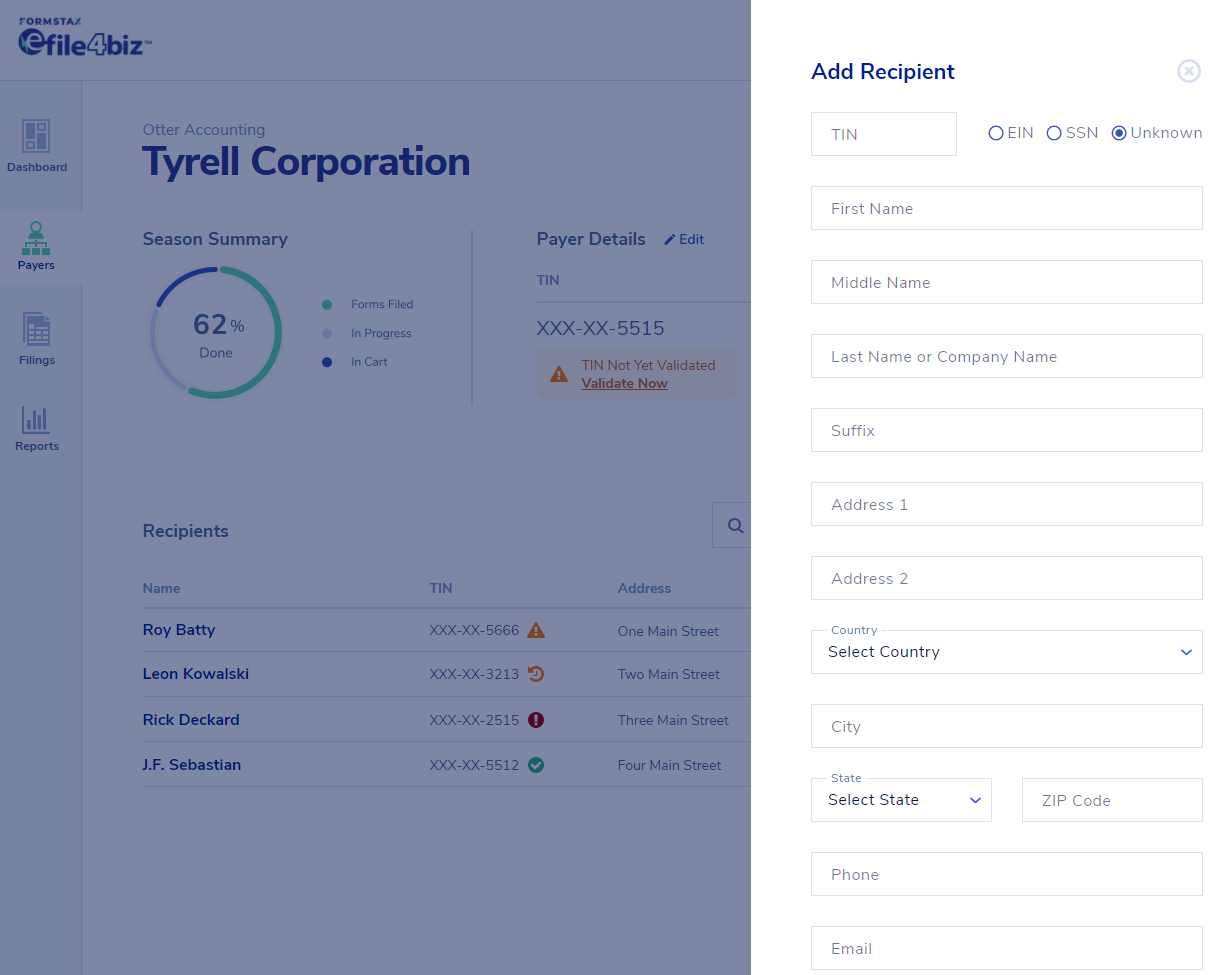

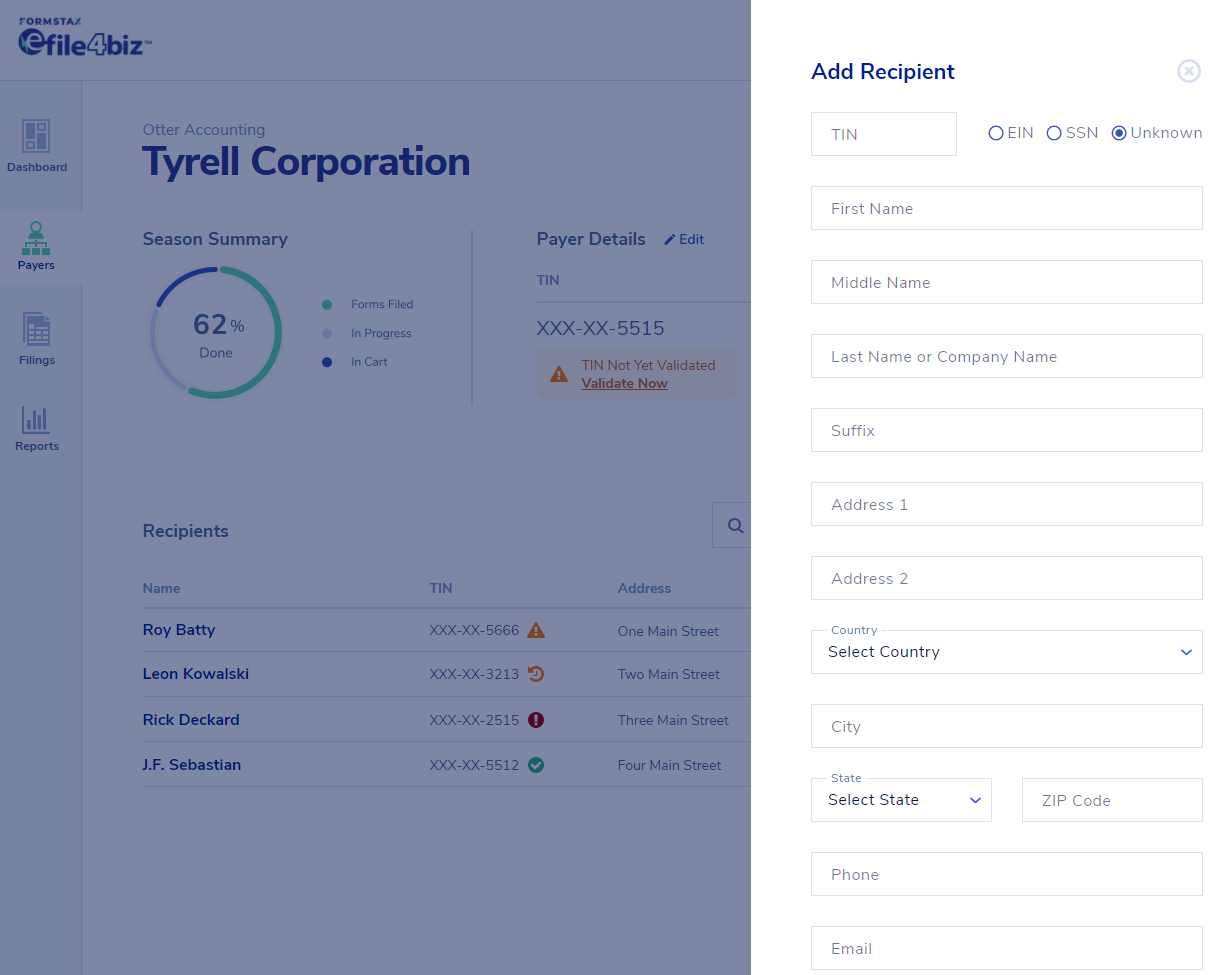

Enter the name, address, and SSN or TIN for each recipient (contractor, employee or other payee). If you wish, enter recipients’ email addresses and we will offer them the option to access their forms securely online.

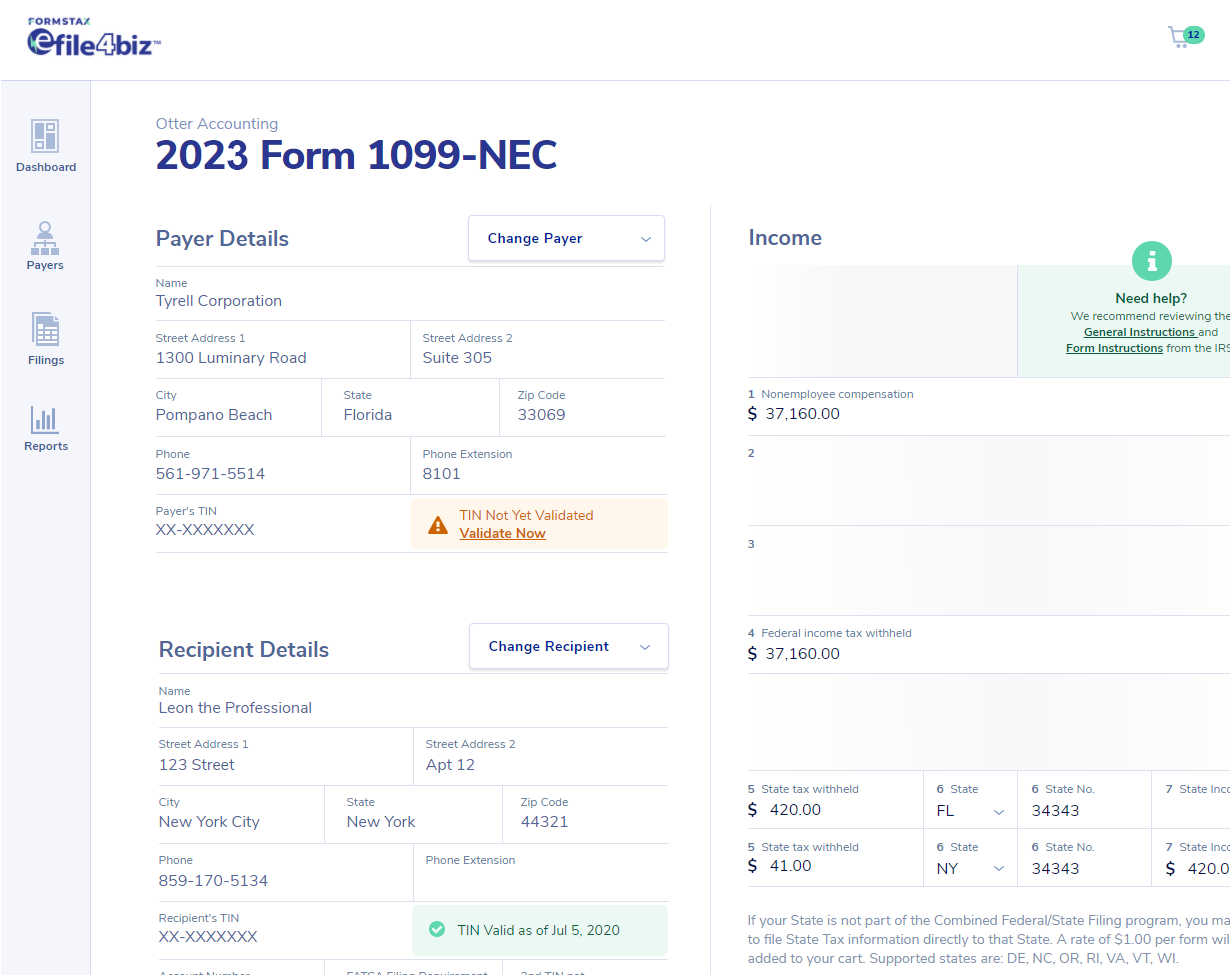

Just select the payer and recipient from the drop-down lists and fill in the required ''boxes'' with the payment amounts. If you’re missing information, you can save partially completed forms in your account and return later to complete and file them.

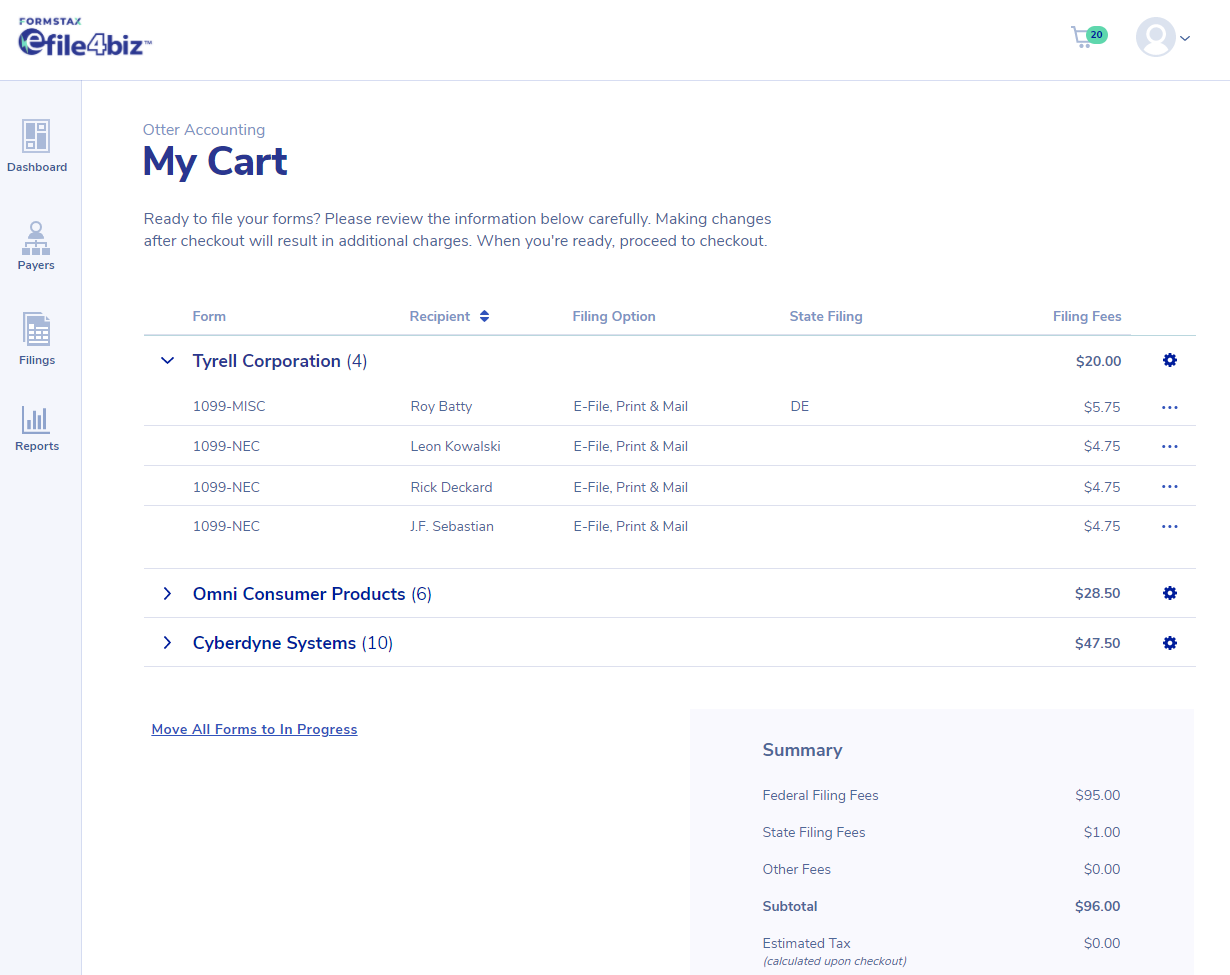

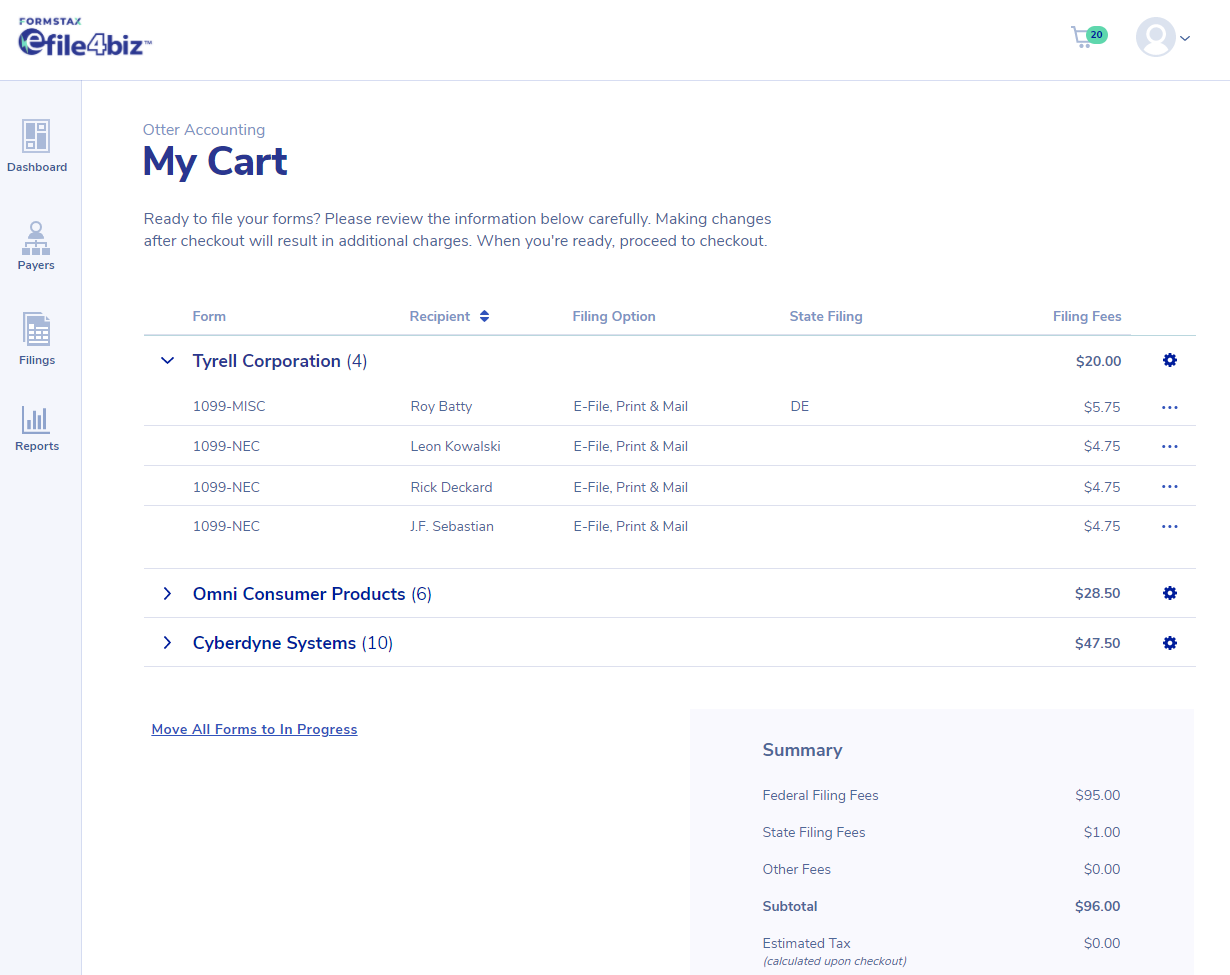

You decide which forms to submit, when you are ready. Add all your forms to the cart and check out once, or submit them in batches (by company, client or form type, for example).

Get a detailed look at the efile4Biz Dashboard here.

Once your forms are submitted, we:

File daily to the IRS and/or SSA, sometimes multiple times a day, during filing season.

Provide forms to your recipients securely via e-mail. No waiting for the mail.

Print and send recipient forms via first-class mail from our SOC 2-certified facility.

Each form filed with efile4biz includes:

E-mail notifications delivered for each completed step.

Printable PDFs of your forms for up to four years after filing.

Storage of payer and recipient data for up to four years after filing.