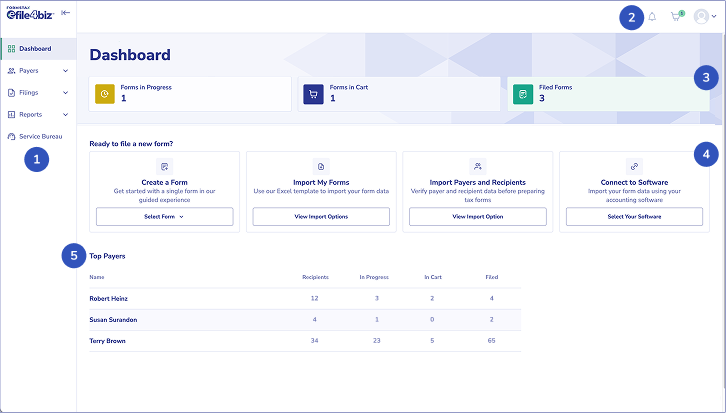

Get to Know the efile4Biz Dashboard

Let's get to know the efile4Biz Dashboard

- The left-hand navigational bar provides a fast way to move to different functions of the platform. Just click on the down arrow for various choices.

- The bell indicates if you have any notifications, the cart indicates the number of forms ready for check out and the person icon when clicked provides a drop down where you can handle various account tasks as well as being a gateway to the Forms & Fees page, Customer Service messaging and a searchable Knowledgebase.

- This section provides the number of forms in each category: in progress, in cart and filed with the IRS or SSA.

- This section provides the following options:

- Create a Form – using the dropdown, you select the form you want to prepare (year and form name) and then you can either type in your payer and recipient details or select them from a drop down menu. Using this choice, you would type in the income amounts.

- Import My Forms – selecting this choice allows you to access the Excel template or use one of our software integrations for importing your data. Importing data is the efficient method to use when preparing more than just a few forms.

- Import Payers and Recipients – this option provides an Excel template for your payer and recipient data only. This choice is used when submitting the data for TIN Matching.

- Connect to Software – use this option if you are connecting to QuickBooks or Xero for importing your data.

- This section of the dashboard lists your payers that were most recently added. It also gives you a quick progress report of the number of forms in progress, in cart and filed for each of the top payers.

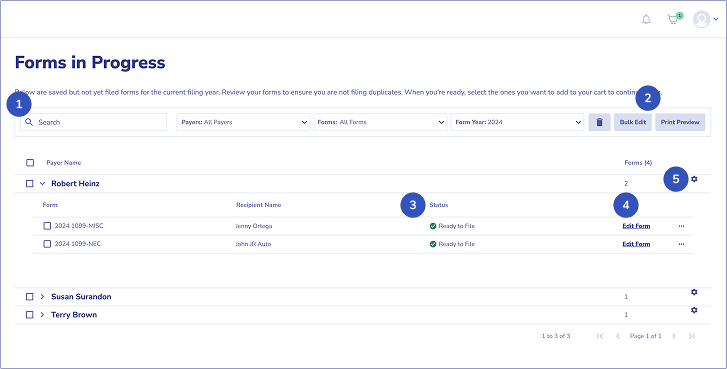

Forms in Progress

- This top row of boxes enables you to easily find or filter specific payers, recipients, form types, form statuses or form years. You can also use the drop down box for Team Members to find work associated with specific staff that you have set up to work on forms. The Team Member drop down is only applicable to accounts set up as Plus or Premium subscriptions.

- This section allows you to delete a form in progress, bulk edit multiple forms, or see a preview of a form in progress. Bulk edit might be used to update the amount box for multiple recipients or highlighted errors on the forms. The Print Preview is very useful for reviewing your work for any errors prior to checking out or printing the form if you want to have your client review prior to submitting.

- The Status field will have one of the following values: Ready to File or Contains Errors. The types of errors that might be highlighted could be incorrect formats or invalid entries for the field.

- Edit Form is a short cut to bring up the selected form for editing.

- The gear allows you to view and edit your payer details and see a print preview of the form. The 3 dots allows you to delete the form, print preview, and view and edit your recipient details.

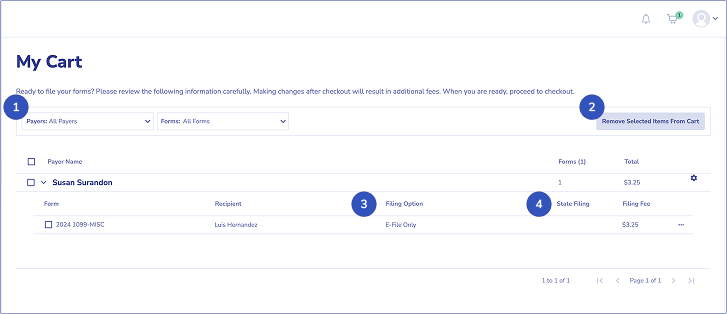

My Cart

- The top row allows you to look at what is in your cart by Payers or Form Types.

- If you decide to remove a form from your cart, it will be moved back to the Forms in Progress page.

- Filing Option is what service you have selected for the form: E-File, Print & Mail; Print & Mail; or E-File Only. If at this point you realize you want a different level of service, you can check the box on the left, click on the Remove Selected Items From Cart, then go back to Forms in Progress to update the service level and then move the form back to your cart.

- This section shows if you have selected State Filing for the specific form and what the total filing fee will be when you check out.

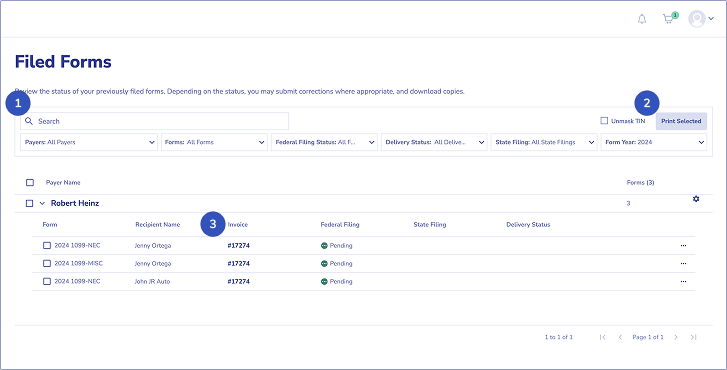

Filed Forms

- The top row allows you to filter what has been successfully checked out by Payers, Form Type, Federal Filing Status, Delivery Status, State Filing Status, and Form Year. The following statuses could be showing:

- Federal Filing Status: Pending, Submitted, Accepted. We do not have any control over how long it takes for the IRS or SSA to accept a form.

- Delivery Status: Pending, Mailed.

- State Filing Status: Pending, Submitted, Accepted.

- You may select to print forms, if you would like a hard copy for your records or to provide a copy for your recipients. If you would like the TINs unmasked, check this box. However, keeping the TINs masked is best practices for security.

- Click on the invoice number to display/print a PDF of the invoice.