Did You Know? Transmittal Forms 1096, W-3 and 1094-B Aren't Necessary When E-Filing!

As a business owner or tax preparer, you know that e-filing your 1099s, W-2s and new 1095s with efile4Biz.com is fast and efficient. Simply enter (or import) your recipient and form data online and we handle the rest – printing and mailing copies to your recipients, filing forms directly with the IRS or SSA, and sending notifications for confirmation.

But that’s not the only way e-filing saves you time and effort. Unlike with paper filing, you don’t have to calculate and submit the 1096 form with your 1099s, the W-3 with your W-2s or the 1094-B with your 1095-B forms. That’s right! As part of our e-file process, we automatically compile the data required on these transmittal forms and file them with the IRS or SSA.

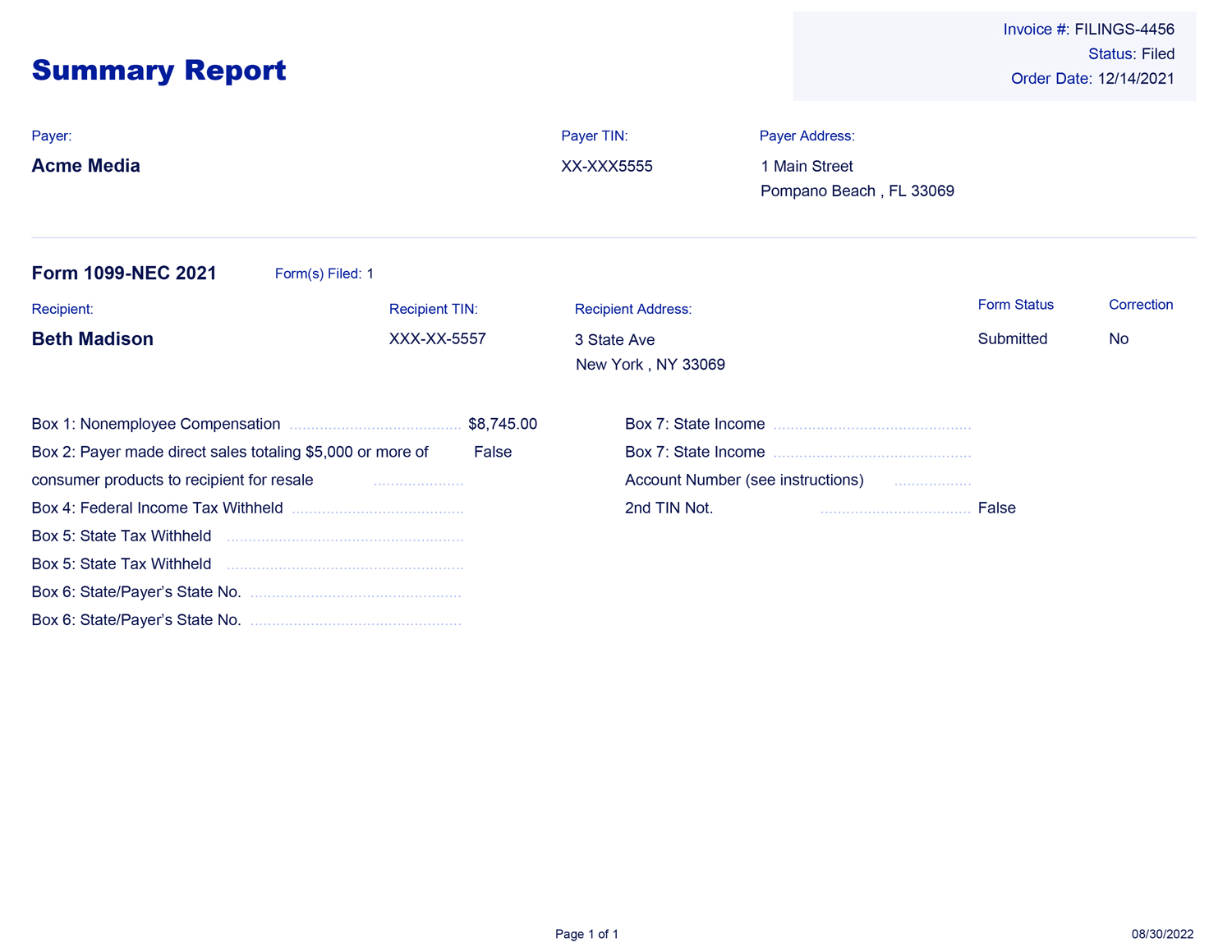

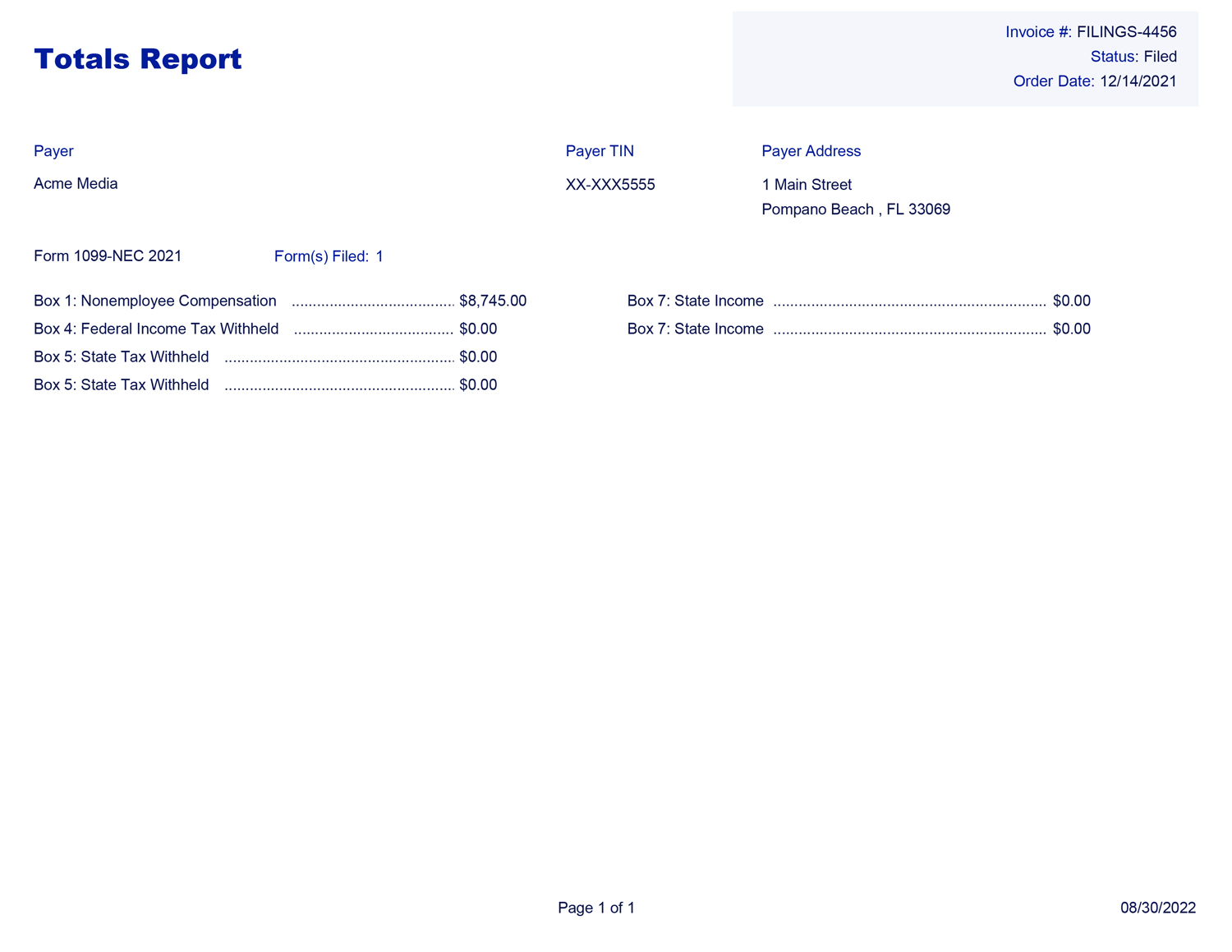

This information is available for review by logging into your account and selecting Reports from the left-hand navigational bar.

Free to try. You only pay when you're ready to file.